Overview

Today’s financial market has changed dramatically and evolved significantly because of the development of the financial technology. The financial products and services in a digital society are more complicated and have been increasingly competitive in a changing fashion. The financial industry must be ready to adapt to the modern era. Further, such technology has a profound impact on financial economics professions. So, it is a big challenge for modern financial economists how to survive in the dynamic financial market.

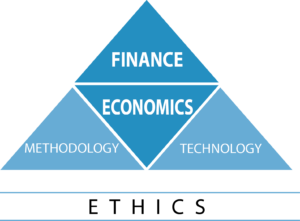

The Graduate School of Development Economics has launched the Master of Economics program in Financial Economics since 2008, focusing on the allocation and deployment of capital resources in an uncertain environment with asymmetric information. The Master in Financial Economics program is a combination of knowledge and application of three pillars: economics, finance, and methodology, to produce finance professionals who can link economy with financial markets, both domestically and internationally, and can apply analytical tools for appropriate financial decision making.

Then, in the year 2017, the curriculum has been updated to keep up the changes by offering two major fields which are investment analysis and financial planning. The professional abilities earned from the program will enable our graduates to advance their career as investment analyst, fund manager, investment banker, researcher, economist, and wealth manager, and become successful in this changing financial world.

Program Philosophy: “Produce professionals equipped with knowledge in economics and finance, have the ability to manage and analyze data, up-to-date with technology, and give importance to sustainable development according to the financial industry dimensions of Environment, Social, and Governance (ESG).”

Program Objectives: “The program aims to qualify students in the knowledge and application of economic theory, finance theory, and analytical tools. It is designed to increase students’ academic knowledge, analytical skills, research competence, along with ethics which will prepare them for success in the financial economics professions.”

Expected Learning Outcomes

1.Apply knowledge of economics, finance, and quantitative methods to serve the demand of financial markets.

2.Analyze and interpret data to solve real world problems with economic and financial theories along with efficient analytical tools.

3.Engage in lifelong learning, career advancement activities, and keep up-to-date with knowledge and technologies.

4.Recognize sustainable development concepts in organizational and societal culture.

5.Communicate effectively in writing and speaking

6.Demonstrate one’s own opinion, while being an open-minded team member

7.Adhere to professional ethics and maintain societal responsibilities.

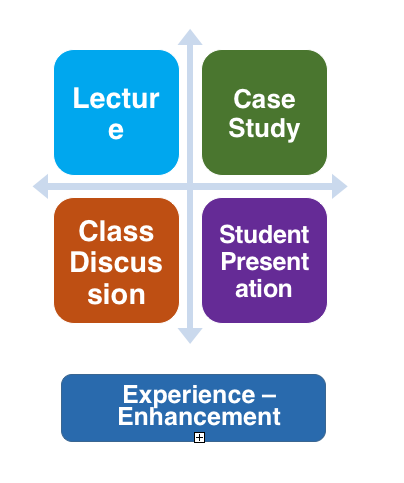

Learning Methodology

Program Structure and Study Plan

Name of Program : Master of Economics Program in Financial Economics

Name of Degree

Master of Economics (Financial Economics)

M. Econ. (Financial Economics)

Major Subject

– Financial and Investment Analysis

– Wealth Planning and Management

Major Subject

– Financial and Investment Analysis

– Wealth Planning and Management

Program Structure

| Course | Plan 1 | Plan 2 |

| Remedial CoursesBasic CoursesCore CoursesMajor CoursesElective CoursesIndependent StudyThesisComprehensive Examination | No credit6 credits12 credits9 credits––12 creditsComprehensive Examination | No credit6 credits12 credits9-15 credits3-9 credits3 credits–Comprehensive Examination |

| Total Credits | 39 credits | 39 credits |

Study Plan

Plan 1 (Thesis)

First Year, 1st Semester

ND 4000 Foundation for Graduate Studies 3 Credits (No Credit)

LC 4001 Reading Skills Development in English 3 Credits (No Credit)

for Graduate Studies

FE 5011 Quantitative Analysis for Financial Economics 1.5 Credits

FE 5012 Financial Econometrics 3 Credits

FE 6011 Microeconomics for Financial Analysis 3 Credits

FE 6013 Corporate Finance 3 Credits

FE 7xxx Major Course (#1) 3 Credits

Total 13.5 Credits

First Year, 2nd Semester

LC 4002 Integrated English Language Skills Development 3 Credits (No Credit)

FE 5013 Research in Financial Economics 1.5 Credits

FE 6012 Macroeconomics and Financial System 3 Credits

FE 6014 Portfolio Theory 3 Credits

FE 7xxx Major Course (#2) 3 Credits

Total 10.5 Credits

First Year, 3rd Semester

FE 7xxx Major Course (#3) 3 Credits

Total 3 Credits

Second Year, 1st Semester

FE 9004 Thesis 3 Credits

Total 3 Credits

Second Year, 2nd Semester

FE 9004 Thesis 9 Credits

Total 9 Credits

Plan 2 (Independent Study)

First Year, 1st Semester

ND 4000 Foundation for Graduate Studies 3 Credits (No Credit)

LC 4001 Reading Skills Development in English 3 Credits (No Credit)

for Graduate Studies

FE 5011 Quantitative Analysis for Financial Economics 1.5 Credits

FE 5012 Financial Econometrics 3 Credits

FE 6011 Microeconomics for Financial Analysis 3 Credits

FE 6013 Corporate Finance 3 Credits

FE 7xxx Major Course (#1) 3 Credits

Total 13.5 Credits

First Year, 2nd Semester

LC 4002 Integrated English Language Skills Development 3 Credits (No Credit)

FE 5013 Research in Financial Economics 1.5 Credits

FE 6012 Macroeconomics and Financial System 3 Credits

FE 6014 Portfolio Theory 3 Credits

FE 7xxx Major Course (#2) 3 Credits

Total 10.5 Credits

First Year, 3rd Semester

FE 7xxx Major Course (#3) 3 Credits

Total 3 Credits

Second Year, 1st Semester

FE 7xxx Elective Course 3 Credits

FE 7xxx Elective Course 3 Credits

FE 7xxx Elective Course 3 Credits

FE 9000 Independent Study 3 Credits

Total 12 Credits

Course Description

Basic Courses

FE 5011 Quantitative Analysis for Financial Economics 1.5 credits

This course covers principles and tools of quantitative analysis such as calculus, derivatives, metrics, and optimization, which are basic for understanding and analysis in finance.

FE 5012 Financial Econometrics 3 credits

The course covers the econometric tool for data analysis in economics and finance, which includes a simple regression model and some advanced methods, e.g., dummy variable and discrete choice model (Logit, Probit), including an introduction to modern data analytics, e.g., data mining method. The learning process is accompanied by real-data examples by the application of standard computer program.

FE 5013 Research in Financial Economics 1.5 credits

This course describes research process, covering research questions and objectives, literature reviews, data collection process, and selection of analytical tools and methods for data analysis to develop and present a research proposal.

Core Courses

FE 6011 Microeconomics for Financial Analysis 3 credits

This course applies the concepts of microeconomics, behavior economics, probability and payoffs under uncertainty, cash flow and present discount value, game theory, and so on to analyze the behavior of various economic agents and economic problems that arise in the economy. The course describes resource allocation through the market mechanisms, behaviors of consumers and producers, decisions under uncertainty, the ethical concepts in decision-making process, consumption involving time, the opportunity cost of capital, production cost management, pricing and non-pricing strategies, market power and market strategies, and the impact of government policies on buyers’ and sellers’ behavior, and on the economic welfare.

FE 6012 Macroeconomics and Financial System 3 credits

This course provides the fundamental macroeconomics concepts and the structure of a financial system and equips students with logical skills and ethical standards for macroeconomic and financial analyses. Topics covers the determination of national income, the role of fiscal and monetary policy, inflation and unemployment, growth theory and business cycles, and lessons from past financial crises, including current financial issues, such as new types of money and investment and their impacts on the economy.

FE 6013 Corporate Finance 3 credits

This course applies the modern corporate financial theory in operating, financing, and investing decision-making, covering basic concepts in investment risk and return, valuation, capital budgeting analysis, capital structure policy, dividend policy, mergers and acquisitions, and other related corporate activities, as well as focus on the firm’s target of maximizing shareholders’ wealth by adhering to ethical standards as well as corporate sustainability concept on three dimensions of ESG (environmental, social, and governance).

FE 6014 Portfolio Theory 3 credits

This course provides the principles of asset allocation, modern portfolio theory, diversification, portfolio construction models, an analysis and management of securities risks, and portfolio management evaluation techniques.

Major Courses

FE 7011 Asset Pricing Theory 3 credits

This course applies asset valuation theory and its applications to real world valuation cases, decision-making tools under uncertainty and risk, including standard asset pricing models used to determine financial asset prices, particularly equity and debt securities, valuation techniques such as discounted cash flows, relative and market-based approaches, and factors affecting the value of financial assets.

FE 7012 Financial Derivatives and Risk Management 3 credits

This course covers derivative markets and derivative securities such as forwards, futures, swaps, and options, focusing on the valuation of derivatives, trading strategies, and the use of derivatives in portfolio management such as risk management and cost management, a variety of underlying assets covering commodities, foreign currencies, fixed-income securities, and equity, and practicing derivatives trading via a trading simulator.

FE 7021 Financial Planning and Wealth Management 3 credits

This course covers the meaning and importance of financial planning and wealth management, the roles and functions of a financial planner, the core principles of financial planning and wealth management, the financial planning process, the characteristics of good financial goals, personal liquidity management, application of time value of money, personal data gathering, the analysis of personal financial statements, and key issues regarding taxation and ethics of financial planner.

FE 7022 Investment Planning and Asset Management 3 credits

This course offers the meaning and importance of investment planning, investment planning process, investment risk and return calculation, the concept of behavioral finance to construct efficient investment plan and asset allocation according to personal financial position, behavior, and individual financial goals.

FE 7030 Financial Innovation and Technology 3 credits

This course investigates the financial innovations in product development and launching process, recent financial technologies adopted in capital market and financial services such as Artificial Intelligence, Blockchain, and Digital Asset to apply in financial planning and management at the individual, organizational, community, and society level.

Elective Courses

FE 7101 Ethics and Elements of Financial Economics 1.5 credits

This course offers the concepts of research ethics, professional standards, and code of conducts related to elements of financial economics, the ethical issues and responsibilities to financial profession and organization, the importance of sustainable development goals (SDGs) in the environmental, social, and governance (ESG) frameworks.

FE 7102 Financial Data Analytics 1.5 credits

This course covers necessary computational skills dealing with financial data, data management, spreadsheet creation, basic programming, for-loop algorithm, root finding, optimization, basic machine learning, and data visualization for financial decisions.

FE 7111 Financial Statement Analysis 3 credits

This course introduces accounting structure, financial reporting principles, the analysis of financial information, financial ratios and other alternative methods to analyze the firms’ financial performance and position, the use the financial information as an effective tool for the financial decision making.

FE 7112 Securities Analysis and Investment Strategy 3 credits

This course explores investment principles and case studies for security analysis, investment process including fundamental analysis, investment strategy, and related investment psychology.

FE 7113 Financial Modeling and Forecasting 3 credits

This course covers the methodology of financial modeling and forecasting economic and financial data, data collection and management, model development, simulation, model evaluation, case study, and applications of computer package.

FE 7114 International Financial Markets 3 credits

This course offers an analysis of the financial system, international financial markets and institutions, recent developments in financial technology and new asset types, international investment, foreign exchange market and exchange rate risk.

FE 7221 Insurance Planning 1.5 credits

This course examines insurance planning, which is an important tool for dealing with the risk of the financial plan, the various types of risks, including causes, frequency, and severity, for assessing impact and approach to deal with risk, the basics, types, and principles of insurance policies, life insurance, health insurance, and non-life insurance to analyzing needs and appropriate policy for an effective risk transfer plan.

FE 7222 Retirement Planning 1.5 credits

This course covers the financial planning process for retirement, the rights and benefits from the Social Security Fund, Government Pension Fund (GPF), Provident Funds, Retirement Mutual Fund (RMF), risk management to build collateral and ensure enough money to live after retirement, investment plan for both before retirement and in retirement phase, which are the crucial factor to achieve the plan’s objectives.

FE 7223 Tax and Estate Planning 1.5 credits

This course explores the objectives of tax planning, an overview of personal income tax calculation, strategic tax planning for salarymen, self-employed, and other types of income taxpayers, estate planning and wills, the types of testament, inheritances, heirship, and other concerns.

FE 7224 Integrated Financial Planning 1.5 credits

This course offers the structure and organization of the financial plan presentation, integrating all financial plans together in a holistic way to meet clients’ objectives, and making the presentation attractive, reliable, and complete.

Independent Study

FE 9000 Independent Study 3 credits

This course enables students to study and present individual research in the field of financial economics under the supervision of a faculty member. It aims to utilize knowledge in finance, economics, and research methodology. The goal is a written academic paper containing significant analysis and interesting results with policy implications.

Thesis

FE 9004 Thesis 12 credits

This course offers students the opportunity to work on a specific research topic in the field of financial economics under the guidance and supervision of a main thesis advisor and comments from thesis committee. The focus is to utilize knowledge in financial economics as well as research and analytical skills in developing the outstanding academic research paper with local or international standards for publication.

Qualification

For students of regular classes

Graduates with a Bachelor’s degree or equivalent from educational institutions accredited by the Office of the Higher Education Commission (OHEC) or the Office of the Civil Service Commission (OCSC), or organizations that have certification standards or academic standings recognized and approved by the Council of the Institute.

1. Graduates with a Bachelor’s degree or equivalent from educational institutions accredited by the Office of the Higher Education Commission (OECD) or the Office of the Civil Service Commission (OCSC), or organizations that have certification standards or academic standings recognized and approved by the Council of the Institute.

2. In interview test cases: have work experience in economics, finance, accounting or other related fields or have investment experience after graduating with a Bachelor’s degree for at least 1 year.

3. In written test cases: Have work experience in any fields after graduating with a Bachelor’s degree for at least 1 year.

The qualifications of eligible applicants may be changed as appropriate in accordance with the announcement of the Institute.